In today’s fast-paced world, managing money has evolved far beyond physical wallets and cash. Whether you’re sending money to friends, paying for groceries, or making international transfers, digital wallets in the UK and the best payment apps have become essential tools for modern financial life. With secure technology, user-friendly experiences, and seamless integration with everyday spending, these apps are transforming how we handle money.

In this comprehensive guide regarding digital wallets in the UK on Mid Monday, we explore the five top payment solutions that offer convenience, security, and innovation for UK users.

What Are Digital Wallets and Why They Matter

Before diving into the specific platforms, it’s important to understand what digital wallets in the UK are and why they’re gaining traction. Digital wallets are apps or online services that let users store card information, make contactless payments, send money, and manage their finances in one place. Unlike traditional wallets that hold physical cards and cash, digital wallets provide a secure, encrypted environment that reduces fraud and unauthorized use.

In an age when smartphones are ubiquitous, digital wallets offer speed, ease, and security, making them indispensable for everyday transactions and global commerce. For UK consumers seeking the best payment apps, digital wallets have become a popular choice thanks to features such as biometric login, fraud monitoring, and quick transfer capabilities.

1. PayPal – A Trusted Global Leader

When people think of digital wallets in the UK, PayPal is often one of the first names that comes to mind. Established in the late 1990s, PayPal has evolved into one of the best payment apps worldwide, offering a robust platform for sending and receiving money both locally and internationally.

What sets PayPal apart is its security infrastructure. With advanced encryption and fraud detection systems, users can feel confident linking their bank accounts or cards to the app. PayPal also lets you pay at millions of online stores without sharing your financial information with merchants, a key reason it remains a top choice among Britons.

Beyond basic payments, PayPal offers additional services such as PayPal Credit, invoicing for freelancers, and integration with e-commerce platforms. For users who prioritize reliability and widespread acceptance, PayPal unquestionably ranks high among digital wallets in the UK.

2. Apple Pay – Seamless Payments for iOS Users

Another standout in the UK’s digital wallet landscape is Apple Pay. Designed specifically for Apple devices, this wallet seamlessly integrates with your iPhone, Apple Watch, iPad, or Mac. With a quick double-click of the side button or a tap at a contactless terminal, payments are authorized using Face ID or Touch ID, making Apple Pay one of the most secure and convenient options available.

For UK iOS users, Apple Pay is one of the best payment apps for in-store and online purchases. Many major UK banks support Apple Pay, allowing users to link multiple cards and switch between them effortlessly. Because it uses tokenization, replacing card numbers with unique digital identifiers, Apple Pay ensures that your financial details are never exposed during transactions.

The convenience of Apple Pay doesn’t stop at payments; it also works with supported transit systems and loyalty cards, further enhancing its utility as a complete digital money solution.

3. Google Wallet – Android’s Powerhouse

For Android users, Google Wallet has become one of the most compelling digital wallets in the UK. Previously known as Google Pay, this app combines payment functionality with a range of other features, like storing boarding passes, loyalty cards, and event tickets all in one place.

Google Wallet is widely recognized as one of the best payment apps for everyday use, thanks to its simplicity and compatibility with a wide range of Android devices. Like Apple Pay, it uses encrypted tokens during transactions, ensuring your card details remain secure. The app also supports contactless payments at millions of merchants across the UK and beyond.

Another advantage of Google Wallet is its integration with Google services, making it easy to shop online, send money to friends, and track spending, while benefiting from Google’s robust security protocols.

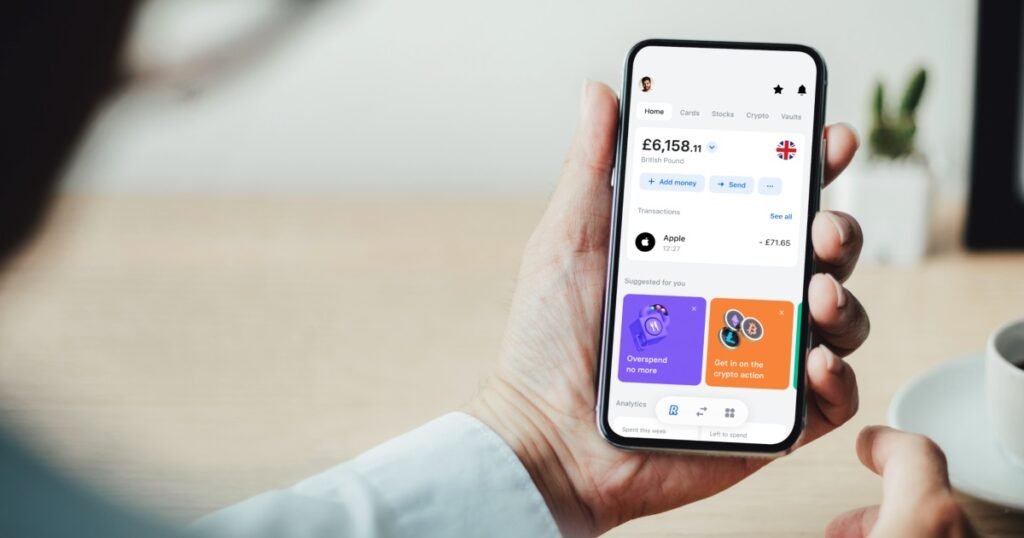

4. Revolut – More Than Just a Wallet

Revolut is often described as a “financial super app,” and rightly so. As a digital bank and wallet combined, it offers an impressive suite of features that differentiate it from other digital wallets in the UK. Beyond simple payments, Revolut allows users to hold, exchange, and transfer multiple currencies at competitive rates, a feature especially useful for travellers.

As one of the best payment apps for both everyday users and frequent flyers, Revolut provides features such as budgeting tools, savings vaults, cryptocurrency trading, and instant peer-to-peer transfers. Its app-first design makes managing money intuitive, and its premium plans unlock additional benefits, such as travel insurance and higher exchange limits.

Security is a strong focus for Revolut, with options to freeze cards instantly, enable location-based security, and receive real-time transaction alerts. For users seeking a more comprehensive financial experience in a single app, Revolut stands out among digital wallets in the UK.

5. Monzo – A Bank and Wallet in One

Last but certainly not least among the top five platforms is Monzo, a digital bank with an exceptional user experience that has made it one of the best payment apps in the UK. Monzo combines traditional bank account features with a mobile-first design and digital wallet convenience.

Monzo’s app lets users make contactless payments, set up direct debits, and use features like bill splitting and savings pots. It also provides real-time spending notifications and smart transaction categorization, helping users stay on top of their finances.

For those focused on security, Monzo uses secure authentication methods and instantly flags suspicious activity. While primarily a bank account, its digital wallet capabilities, including Apple Pay and Google Wallet integration, make it a versatile option for UK users looking to consolidate their money management into one app.

Choosing the Right Digital Wallet for You

When selecting a digital wallet in the UK, consider your daily financial habits, the devices you use, and the features that matter most to you. Whether you value global acceptance (like PayPal), seamless device integration (like Apple Pay and Google Wallet), currency flexibility (like Revolut), or everyday banking convenience (like Monzo), there’s a payment app to fit your needs.

Security should always be a top priority. Look for digital wallets that offer encryption, biometric authentication, and real-time alerts to protect your finances. Luckily, the best payment apps today invest heavily in these technologies, giving users peace of mind alongside convenience.

Keep In Mind

As cash continues to decline and contactless payments rise, digital wallets in the UK are rapidly becoming essential financial tools. From the trusted ecosystem of PayPal to the all-in-one capabilities of Revolut and Monzo, these platforms represent the future of money management.

At Mid Monday, we believe in empowering readers with up-to-date insights on financial technology. Choosing one (or more) of the best payment apps means you’re not only keeping pace with digital trends, but also gaining convenience, visibility, and security for your everyday financial life.

Ready to streamline your money management? Explore these digital wallets in the UK and discover which fits your lifestyle best.